Going Solo: Why Self-Employed Individuals Should Choose a Solo 401(k) Over a SEP IRA

- Scott H. Tonai, CFP®

- Jul 17, 2025

- 3 min read

Updated: Oct 1, 2025

So far in 2025, we opened more Solo 401(k)s than ever before. While this type of account has been available since 2001, recent updates to the retirement plan landscape have made Solo 401(k)s more flexible and accessible than ever.

Many sole proprietors are familiar with SEP IRAs. They’re simple to set up and have long helped small businesses save for retirement. But when it comes to contribution potential and tax savings, Solo 401(k)s now offer a powerful edge.

Two Buckets of Savings

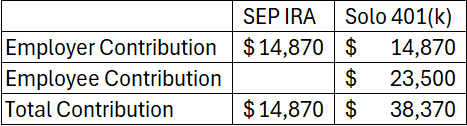

Unlike SEP IRAs, which only allow employer contributions, Solo 401(k)s let you contribute as both the employee and the employer. This dual-contribution structure means you may be able to save significantly more each year.

Let's Look at an Example

Jane owns an online design company and pays herself $80,000 in 2025.

With a SEP IRA, she can contribute 20% of her adjusted net earnings, calculated at $74,349, which works out to $14,870.

With a Solo 401(k), she can still make the same $14,870 employer contribution, plus an additional $23,500 in employee salary deferrals.

That’s a total of $38,370 in tax-deferred savings—a difference of $23,500 over the SEP.

Keep in mind: The Solo 401(k) employee deferral limit ($23,500 in 2025) is not based on a percentage of income, meaning you can fully max it out even at lower income levels. There is a cap of 100% of income if you make less than $23,500 in 2025.

Bonus for Age 50+: You can contribute an additional $7,500 in catch-up contributions. If you're between ages 60 and 63, you may be eligible for a higher "super catch-up" limit—up to $11,250 in 2025—thanks to new rules under the SECURE 2.0 Act.

Tax Savings in Action

Jane wants to boost her retirement savings without increasing her tax bill.

With the SEP IRA, her contributions reduce her income to $65,130. After the standard deduction of $15,000, her taxable income is $50,130, leading to an estimated federal income tax of $5,943.

With the Solo 401(k), her contributions bring her income down to $41,630. After the same $15,000 deduction, her taxable income is $26,630, resulting in just $2,957 in federal tax.

That’s $2,986 in tax savings—just by choosing the Solo 401(k).

Pay Yourself First

Many sole proprietors hesitate to increase their take-home income, opting instead to reinvest in their business. While business growth is important, so is personal financial security.

Contributing to a Solo 401(k) lets you pay yourself first while significantly reducing your taxable income. It's one of the smartest, most flexible ways to build wealth as a business owner.

Let’s Talk Strategy

Comments